Our industry is full of extremely successful personal trainers; many of whom share the goal of opening their own facility and being their own boss. For many of them, the passion and level of education for training clients is a well-developed skill that has been finely tuned over many years of practice. However, the education for opening, operating and maintaining a successful thriving business is typically an area of knowledge they lack. Many trainers pull the trigger on opening their own facility without doing their due diligence.

Creating a basic budget that includes current sources of income, current expenditures, projected opening and operating costs and forecasting new potential business (revenue streams) are a few preliminary steps a potential studio owner should produce prior to consideration. The financial outcomes of this budget will assist in providing some feedback to consider prior to making the decision on opening a facility and determining if it is a financially sound decision.

First off, let’s look at the current revenue streams and annual income of a seasoned and successful trainer. For this example, let’s assume that this trainer has been renting space (subleasing) from a local gym, she works nearly 60 hours a week, has a loyal following of clients who have committed to follow her to a new local location and is strongly considering the possibility of opening her own facility. Below you will see a breakdown of her income from current personal training (one-on-one), semi-private group training (two to four people) and her monthly program design (workout programs for clients to do on their own).

*Note: all figures noted in tables below are estimated sample averages. Consider your actual costs that are individual to your business situation, location, etc.

Sources of Revenue (Monthly and Annually):

Current Expenditures (Monthly and Annually):

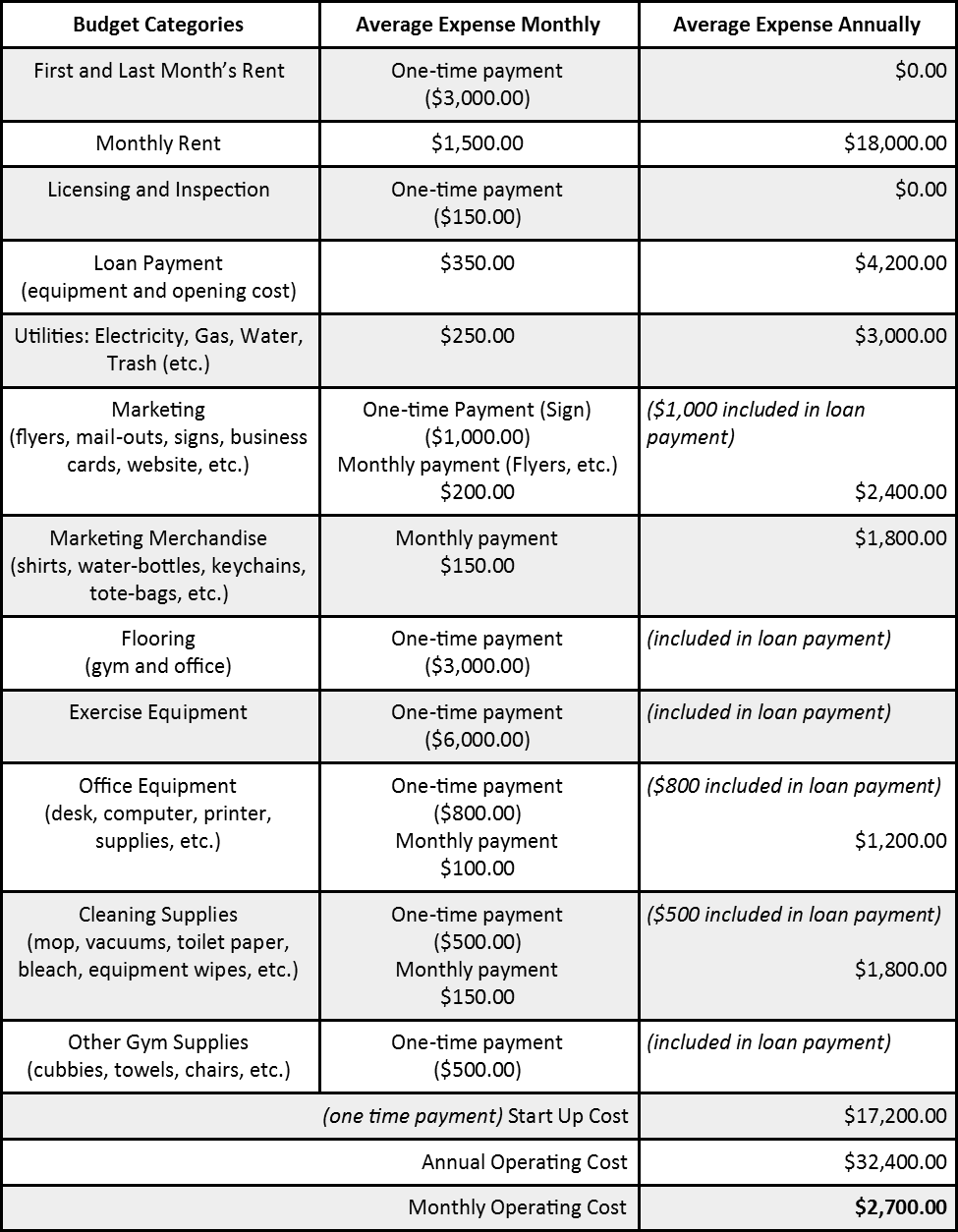

Next, let’s look at the opening and operating costs that she will need to absorb in order to get her new facility and business up and running. There are many "hidden" expenses that the inexperienced trainer/business owner does not consider.

| The day-to-day operational costs can add up quickly and are typically out of site out of mind type expenses. These expenses can range from custodial fees, soap dispensers and toilet paper rolls to the obvious expenses such as purchasing flooring, shipping equipment and paying the electric bill. |

Opening and Operating Costs (Monthly and Annually):

(*based upon a 1500 square foot facility that has been prepared by the owner at no cost to the trainer)

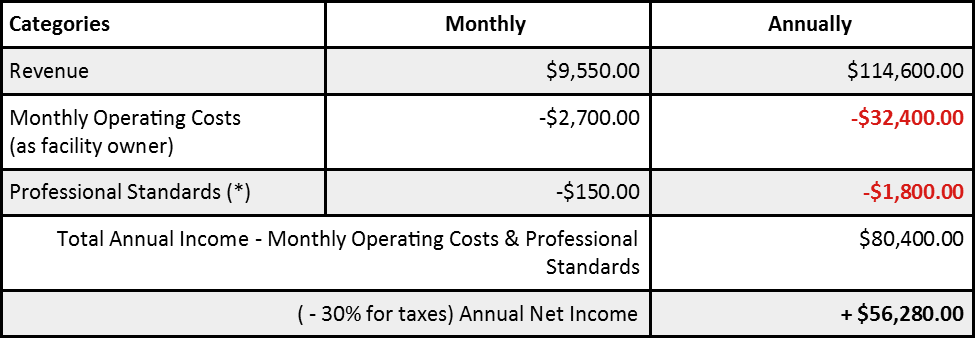

In creating this budget we have found what our trainer's current revenue streams are: her current income, her expenditures and her opening and operating costs to get her business going. Our next step is to see "IF" her current expenditures and opening costs can be covered by her current income. If her financials are good, then opening her own facility is the next step. If her financials are not good, she will need to look at additional revenue streams to help boost her overall income.

(*) Many of her monthly expenses as a subleasing trainer have been absorbed into her monthly operating costs (rent, marketing, telephone, etc.) leaving only professional standards as an additional expenditure (recertification, continued education, liability insurance, etc.)

Final review

Upon final review of our trainer’s budget, we can see some great data. Her total gross revenue of $114,600 will be maintained and her subleasing expenses will be included into her facility monthly operating costs with exception to her professional standards cost (see note above). Her overall expenses (monthly operating cost + professional standards) now totals $34,200 a year leaving her with $56,280 net income (after taxes).

Based on this data we can see that opening her own facility would be a financially responsible move in her career as she progresses from a subleasing full time trainer to a successful gym owner. Although her net income stays the same the opportunities as a facility owner provides multiple new revenue streams with which to grow her business. Listed below are two potential options our trainer can pursue to generate more revenue as a business owner.

1) Offer membership: Our trainer has 35 clients that currently pay for personal training services only. Now that she owns her own facility she could offer membership options. Membership needs to offer additional value to justify the additional cost which could include a coffee station, weekend yoga classes, open gym time, educational seminars and newsletter, etc. For example, a monthly membership of $30 for all 35 clients generates an additional $1,050.00 a month (or $12,600.00 a year).

2) Generating new clients/membership: Our gym owner is going to train her current clientele during certain hours of the day however, the gym "CAN" be open all day long pending the addition of anther trainer or two. In some cases, a new trainer will bring clients with them or a solid marketing campaign can gain new business quickly for an additional trainer (or two) with an open schedule. The addition of 10 new memberships/clients can create an additional revenue of $2,300.00 or more.

Shifting from trainer to owner

With the responsibility of opening her own facility comes the time commitment to running the daily operations of the business. That time commitment typically means that our gym owner will need to step back from the amount of time she spends training her clients (working "IN" the business) and commit more time to managing her facility (working "ON" the business). Stepping back from training clients is a hard but very necessary realization that every trainer, turned gym owner, must come to terms with.

The commitment and demands of being an entrepreneur are vast. Running a successful business is time consuming and can be overwhelming at times for even the most experienced fitness professional. Simply put, our gym owner cannot do it all. With a solid team of trainers at her side our owner will be able to pull back from working with her clients and produce an opportunity for her team members to gain experience. This will provide her time to address the daily business demands and to pursue future business endeavors while maintaining and/or possibly growing revenue at the same time.

Utilizing the information from the budget created above a trainer can now gain a better understanding of their financial standing and the costs of opening and operating their own facility. With an educated mindset, a solid business plan (maybe an experienced mentor by your side) and a well thought out budget you can be very successful in this industry owning and operating your own business. Make sure you are confident in your decisions, do your homework, take your time, listen to your instincts and trust your budget. The numbers never lie.